Jade Global, an eminent IT Technology Partner in partnership with Plaid, a leader in Digital financial technologies, has built "KYC-In-a-Box" - a smart digital solution for enterprises where customer due diligence matters

KYC programs are critical in financial services for customer gain and retention. But the key challenge is how to get as many good users onto the platform as possible while also reducing the amount of fraud as much as possible. Usually, companies think that these two aspects are diametrically opposed. Because if the goal is to check anti-fraud, then it requires introducing more fraud tools, which leads to more friction. But it need not be that way.

To make the KYC processes smoother, smarter, and faster, Jade Global, in partnership with Plaid, has built a smart digital solution called 'KYC-In-a-Box' that helps enterprises better manage their operational risks around KYC compliance. KYC-In-a-Box is not a one-size-fits-all solution. Instead, it is an adaptable framework that can be custom-built and integrated into an on-and-on fashion to address the ever-emerging pain areas in financial services.

This blog delves into the key challenges that financial institutions face throughout the KYC process and how KYC-In-a-Box is thoughtfully built to address those challenges.

KYC Process Challenges

Banks, trading, insurance, wealth management, and mortgage are the key sectors wherein companies are regulated by anti-money laundering laws. Even Casinos, Money changers, and the Jewel industry too need to be a complaint.

A few key challenges faced by organizations throughout their KYC processes are:

- The high volume of work

There's slack in doing a practical KYC refresh for individuals and corporations. Because it must run continuously and depends upon the risk profile of the individual or the customer, KYC refresh must be done annually or maybe once in three years and once in five years. That means quite a bit of work. Every day this process must work, and the volume of the work is very high.

- Identification of politically exposed persons

It is important to identify the politically exposed person. And many of these filtration operations are very manual. Manual processes are slow, and the advent of new fintech partners and new payment methods introduces new risk elements.

- Legacy systems

Another major challenge, especially with banks, is that businesses use legacy systems that they have built over the course of years or decades with the layering of different solutions. The resulting system is a hodgepodge of multiple and overlapped systems that don't speak with one another efficiently. And because of that, from the user experience, there's a ton of friction in the verification flow.

Many banks employed KBA as their main form of fraud prevention. KBA is a knowledge-based application that uses an archaic form of identity verification in which users are asked questions like

- What street did you live on in 2010?

- What color was your car?

- Who did you open a bank account with XYZ?

These personal questions are associated with customers' identities, but fraudsters have easy access to these answers.

Critical Success Factors to Reduce KYC Frictions

Here laying down some of the critical success factors:

- Domain Knowledge- Businesses need a solution that is quite loaded with domain-centricity. Sensitivity towards the domain is important.

- Operations- The operations should have a seamless workflow, especially when multiple disparate applications are used.

- Reliable data- The third factor is the availability of reliable data that can be consumed in the least amount of time. That requires building a 360-degree view of customers by building a “datalake” with the integration of the system of records.

- Customer Outreach- The fourth critical step is customer outreach. Without good data about a customer, it is impossible to build a system that is low in friction for customers as well as backend administrators. Here is a common example- if the same bank or organization hits its customers with the same questions again and again during retail banking, wealth management, and insurance, the chances of getting the response are very less.

As mentioned earlier, businesses have developed their systems over the years, layering multiple solutions together. And that's where the fraud falls through. Thus, having a customer 360 view of an individual, from onboarding to identity verification to account linking to ongoing OFAC screening, is important.

KYC-In-a-Box – A Fully Integrated Solution

Considering the challenges and success factors mentioned above, it is important to have a fully integrated solution that looks at all the pieces together and orchestrates the KYC process. KYC-In-a-Box, a digital solution built by Jade Global in partnership with Plaid, is a fully integrated solution to streamline the KYC processes. With one solution, you can handle multiple verification methods, including authoritative data sources, documentary, and selfie checks, minimize risk with an anti-fraud engine, and screen against government watchlists.

Depending on what kind of specific issue needs to be addressed, KYC-In-a-Box can be customized. The key benefit here is that it eliminates the need to keep layering multiple different solutions whenever there is a need to address a specific issue. It ensures that the organization systems talk to one another well and feed into a greater ecosystem coherently.

Key Benefits of KYC- In-a-Box

- Frictionless customer experience without sacrificing security

Verify identities in as little as 10 seconds for autofill with a conversion-optimized experience. You can define granular success criteria and automate seamless step-up checks based on your risk levels.

- Built-in anti-fraud engine

It helps you detect and prevent fraud on your platform, like synthetic identity fraud, presentation attacks, and account takeovers.

- Ongoing AML compliance

Watchlist Screening Monitor scans your customers automatically against the latest government and politically exposed persons (PEP) lists. With proprietary data enrichment and international name matching, Monitor ensures the highest accuracy and low false positives.

- Reduced manual work

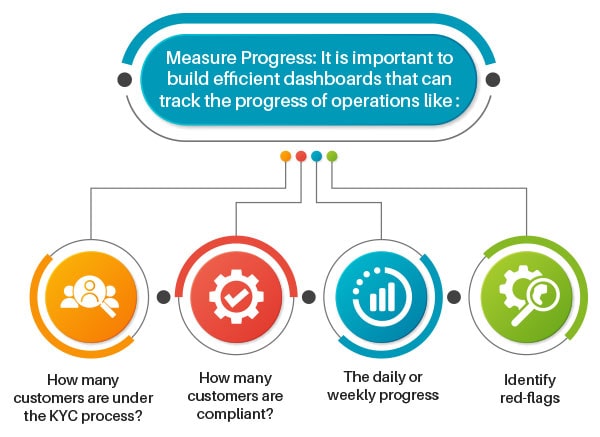

Optimized compliance workflows with our dashboard to reduce manual work. You gain a complete case management and compliance CRM system to clear pending review queues and manage cases easily. These workflows can be customized with experience tools such as autofill and behavioral to create a frictionless experience for your customers.

How Do You Get Started with KYC-In-a-Box?

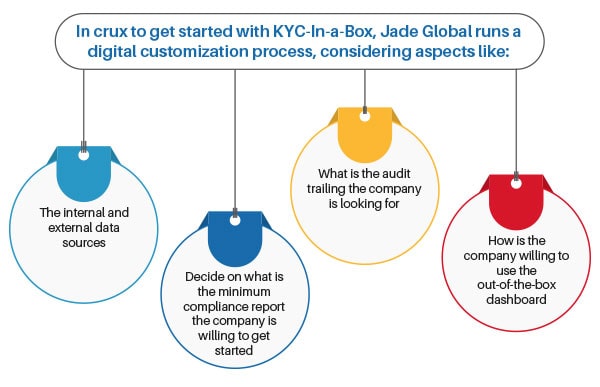

We have partnered with many leading financial institutions and fintech and understand there is no one-size-fits-all approach to KYC. That's why KYC in a box can be configured to your unique needs and help modernize your verification approach.

KYC-In-a-Box comes with the preferred components, which are loosely coupled. These components are adapted to the use cases and can also make a lot of use of existing legacy applications. Also, there is always flexibility to build things around depending on the market and its compliance needs. For example, considering that the market is North America, there will be a simple design workshop to check on what features are directly available to us from the KYC-In-a-Box, what more needs to be customized, and where exactly it must go integrated with the existing applications.

Endnote

Jade Global and Plaid complement each other to build open compliance applications and frameworks for banking and finance companies. KYC-In-a-Box brings together Jade's expertise with technology and the financial market knowledge of Plaid. With an adaptable framework, KYC-In-a-Box is helpful for any financial institution, irrespective of what customer size they cater to, which market they operate in, and what existing applications they are using. KYC-in-a- box needs to be used in an on-and-on fashion. Doing the complete heavy lifting in one snapshot is not the right way because businesses keep discovering new challenges.