Introduction:

Collections are one of the vital functions of each organization. Organizations with a modern and efficient collection process are more productive, disciplined in nature, and enjoy good relationships with customers. They are good at financial compliance and corporate reporting. They Provide accurate and real-time information.

Oracle Cloud Advanced Collection, which is part of Oracle Cloud Financials offering, provides a complete and integrated solution to all collection needs of an organization like dashboards for monitoring collection activities, managing delinquencies, promises, bankruptcy, disputes, customer scoring, Collection metrics, strategies, and tasks.

Key Features of Cloud Advanced Collection:

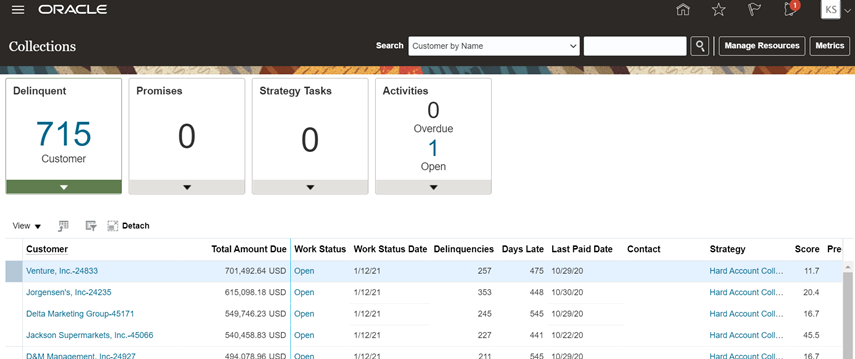

- Interactive dashboards for detail and real-time information: The collection dashboard provides different infotiles with summarized information related to delinquency, promises, strategies, and activities, further drilled down to detailed information. A collector can assign tasks, activities, promises, strategies, or let the system manage these activities automatically based on scoring formula and strategy.

- Collection Metrics: Collection metrics are a feature available as part of the advanced collection to measure your collection process's performance and effectiveness. You can monitor and quantify the collector's efforts and productivity based on industry standards and KPI's. It comes with graphical charts and PIE diagrams for easy reference and focused attention.

- Customer allocations to a collector based on responsibilities, region, and performance: The collections manager can assign and reassign all customers or a few customers from one collector to another collector. Assign a backup collector to an existing collector. Based on collector performance, the customer's assignment can be managed for optimum collections. Each collector has his dashboard to monitor and act upon.

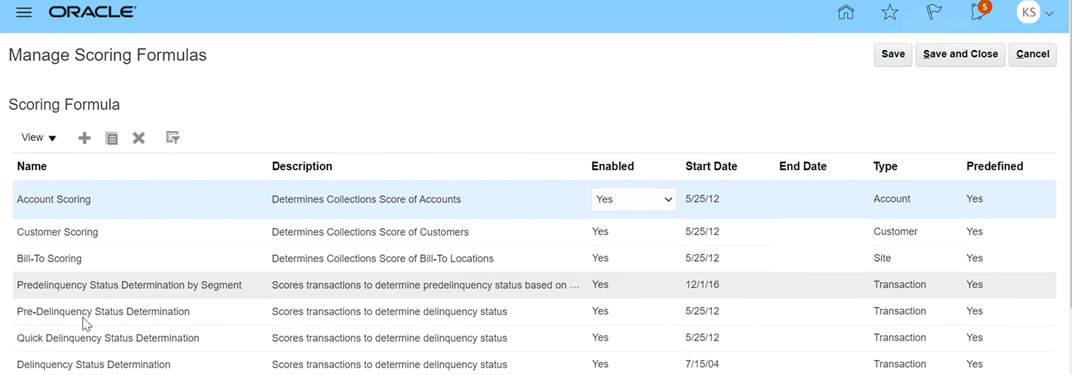

- Delinquency status assignment based on scored value: Based on the scoring formula, a score is assigned to the customer and customer account. Each transaction is scored to determine the delinquency status. And based on the score, you can evaluate the collection strategies to be followed for a robust collection process. You can view and edit the customer's information by selecting delinquent customer information hyperlinks based on customer name, work status, and aging bucket.

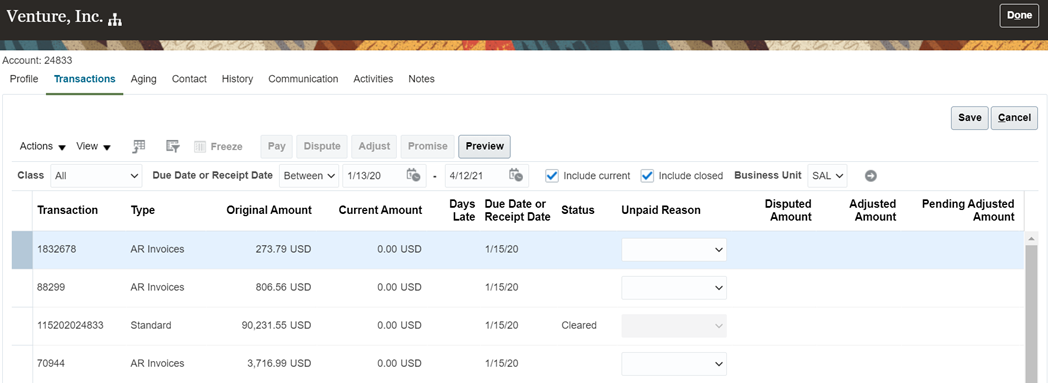

Go to Transaction Tab > select Transaction > Use preview, disputes, adjustments, promises options.

- Customizable scoring engine with wide elements of choice: You can define your scoring formula to match your business requirement. The advance collection comes with seeded scoring elements, which can be used for configuring the scoring logic. Before using the scoring formula, you can test it for sample customers or transactions.

- View and edit detailed customer account information: Through the advance collection, you can have direct access to the customer and customer account database. You can view current and historical customer information and, if needed, can edit required customer information for all recent updates. With updated customer information, you will not lose time and effort in the primary collection process.

You can change customers profiles, contacts, method of communications, payment types, statement cycles.

- Integrated customer payment solution: Use advanced collections to record and process customer payments. A collector can use any payment method like EFT, Wire, Check, and Credit cards to process customer payments against open receivables or past arrears. The advance collection is tightly integrated with receivables and payables for payment validations and checks. You can record full payments or partial payments in any currency.

- Create promises and monitor broken promises: A collector can record a payment promise with agreed pay-to-date and can monitor the discrepancies. The collection dashboard displays all entered and broken promises, which help the collector take necessary action.

- Manage Disputes and Adjustments: From the collection dashboard itself, you can record disputes for any amount or quantity related to Tax, shipping charges, freight, etc. You can also adjust directly from the collection dashboard (which was usually done from receivables modules). These adjustments are allowed based on approval limits granted to specific users.

- Real-time customer aging with a single click: You can have real-time aging information for a delinquent customer.

Based on the preferences setup, you can see the default customer aging information of the customer. From Customer, hyperlink goes to Customer details and then go to Aging Tab for aging information. Here, all transactions form the outstanding balance and further drill to each transaction by clicking on the transaction number.

- Complete transaction view with current and historical activities: From collection dashboards, you can see all delinquent customer information. Using the customer hyperlink, you can also view transaction details for a customer at the Customer level and account level.

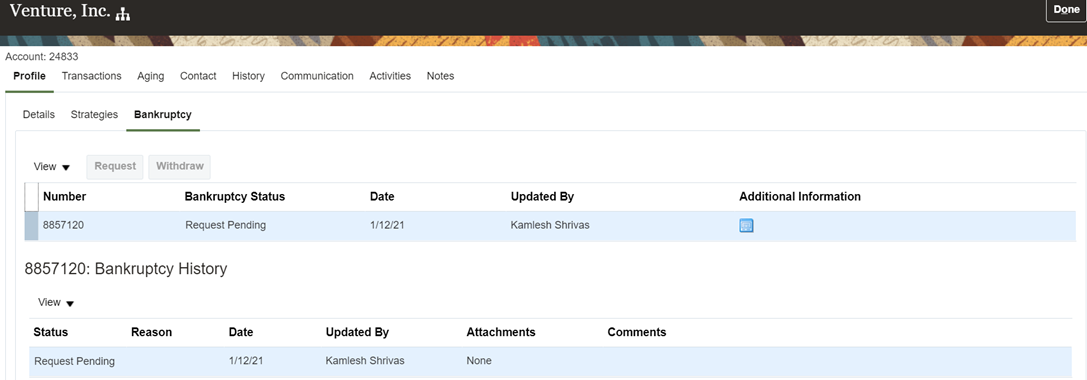

- Manage Bankruptcy: On behalf of the customer, you can raise a request for bankruptcy from the Collection dashboard.

Bankruptcy request contains information for claims, attorneys involved, filing location, and any other legal information. It consists of a review and approval process. Upon approval, the status of the customer is updated to Bankrupt.

All collection activities of this customer are suspended, and related transactions are cleared from the collection dashboard.

- Send Dunning and statement: Advance collections provide different seeded templates (which are also a customizable per requirement) for dunning and statements that can be sent to delinquent customers by email, fax, or print. Collection agents for the speedy collection process can record follow-up calls and notices. The collection agent can monitor all these letters, notices sent to customers and decide his/her future collection strategies.

- Assign strategies and tasks: From the collection dashboard, you can assign collection strategies that are nothing but a group of tasks to be followed in sequence to expedite the collection process. These tasks can be assigned manually or automatically based on the customer risk score. You can also add new tasks to match your business requirement and collection process.