The core principle of IFRS 15 is that revenue is recognized when the goods or services are transferred to the customer, at the transaction price. A 5-step model for revenue recognition in accordance to core principles are shown below

- Step 1 – Identify the Contract with customer

- Step 2 – Identify Separate Performance Obligations with contracts

- Step 3 – Determine the Transaction Price

- Step 4 – Allocate the Transaction Price

- Step 5 – Recognize Revenue

Key Features

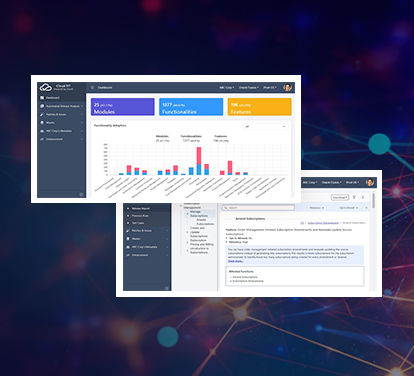

Oracle’s Revenue Management Cloud Services (RMCS) provides a centralized and configurable platform in recognizing revenue that confirms with ASC 606 and IFRS 15 accounting standards for “Revenue from Contracts with Customers”, following the contract process in 5-steps along with strong analysis and reporting solution.

- Identify and Create the Contract with a Customer

- Identify the Performance Obligations in the Contract

- Determine the Transaction Price (TP)

- Allocate the Transaction Price

- Recognize Revenue when or as the entity satisfies a performance Obligation

- Lucid insights with analysis and reporting

- Increased Control with audit