In March 2023, Oracle shared a roadmap for E-Business Suite (EBS) 12.2, and announced its commitment to continue innovation and long-term premier support for Oracle EBS until 2034.

This announcement helped satisfy the immediate concerns about sunsetting the platform. So, how should existing customers proceed with their use of Oracle E-Business Suite modules like EBS Financial? What are the best practices to validate the accuracy and ensure the protection of information within Oracle EBS Modules?

Taking the cue, this blog discusses the complexities of Oracle EBS testing with reference to Oracle EBS Financial Functionality and the best practices for navigating this complexity.

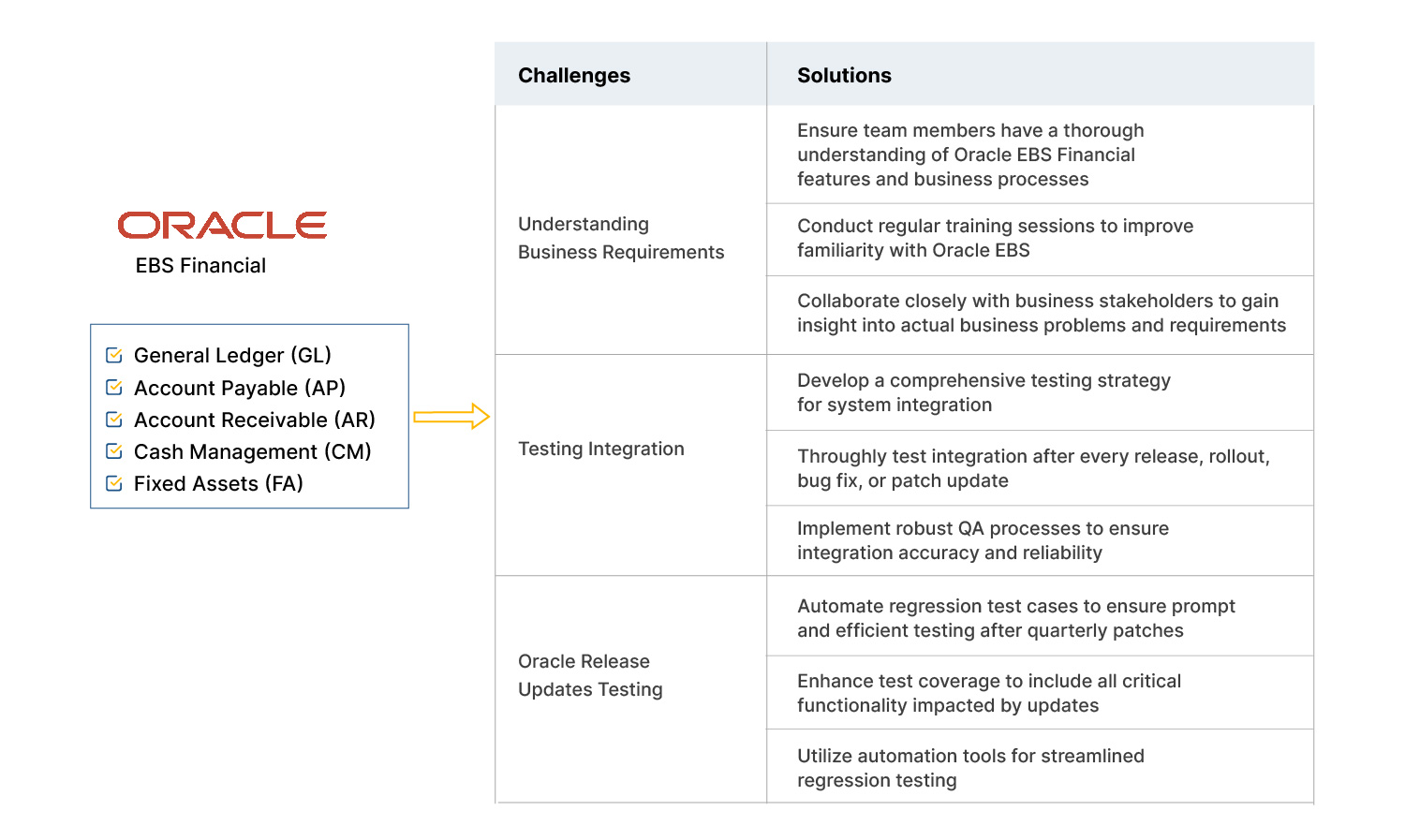

Oracle EBS Testing can be tricky to test due to the 3 challenges

Along with these modules, there are multiple third-party applications that easily integrate with the EBS financial system. Oracle EBS Financial is easily integrated with Workday, ADP, Vertex, Concur, WEBCAS,Zuora RevPro and many other applications.

Integrating third-party services into Oracle EBS Financials can be a complex process, and testing this integration comes with its own set of challenges. The challenge is to ensure seamless communication and data exchange between Oracle EBS and third-party applications while maintaining integrity and performance.

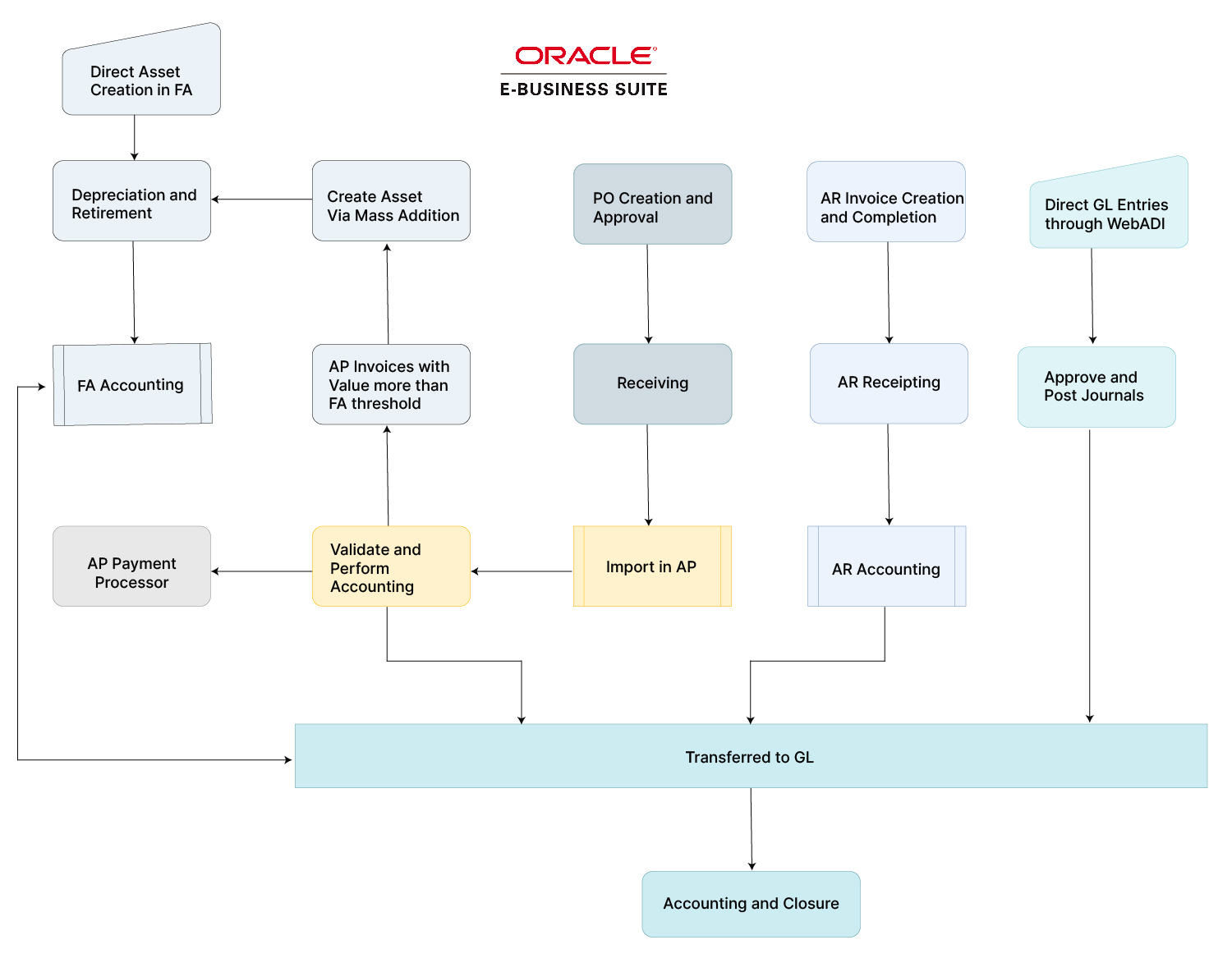

High-Level Flow Diagram of EBS Financial

Displayed below is the fundamental workflow diagram of Oracle EBS Financials, representing comprehensive functional testing within the context of large-scale enterprise financial operations.

In the Accounts Payable (AP) module, data flows from the Purchasing module through the Payables Open Interface process, subsequently undergoing validation and accounting processes in AP to facilitate payments through the Payment Process Request (PPR). Moreover, AP invoices categorized as asset creation trigger the Mass Addition program, initiating the creation of assets, which then undergoes the standard depreciation process.

Within the Accounts Receivable (AR) module, transactions sourced from a third-party system are seamlessly integrated into EBS. These transactions undergo accounting processes within EBS, and all relevant sub-ledger entries are transferred to the General Ledger (GL). This streamlined process ensures accuracy and transparency across financial records.

In the General Ledger (GL) module, users can conduct comprehensive accounting activities and seamlessly execute closure processes.

KPI Driven Best Practices to Perform EBS Testing

Below is a matrix outlining the key performance indicators (KPIs) for Oracle EBS testing based on the importance of testing in various areas. The importance is categorized into three levels: High, Medium, and Low.

| Testing Area | KPIs | Importance |

|---|---|---|

| Report Accuracy | Data Consistency | High |

| Report Rendering Time | Medium | |

| Report Drill-Down Validation | Medium | |

| Transaction Processing | Transaction Throughput | High |

| Transaction Accuracy | High | |

| Exception Handling | Medium | |

| Compliance Assurance | Regulatory Compliance | High |

| Audit Trail Validation | Medium | |

| Securing Financial Data | Access Controls | High |

| Data Encryption Validation | High | |

| Seamless Integration | Integration Testing Success Rate | High |

| Data Synchronization | Medium | |

| Customization Validation | Customization Impact Analysis | High |

| Customization Stability | Medium | |

| User Acceptance of Custom Features | Medium |

This matrix can serve as a guide for prioritizing testing efforts based on the importance of each test area to Oracle EBS financial applications

In today’s environment, there is a lack of investment in the automation testing of Oracle EBS applications. However, to maintain the stability and continuity of the existing system, it is necessary to make a small but significant investment in automating Oracle EBS testing. This allows companies to perform regression testing more efficiently, ensuring that their Oracle EBS applications remain reliable and functional.

Conclusion

Despite the rise of cloud applications, EBS remains a vital reference point due to its robustness and established role in financial operations. However, within EBS Financial, the complexity of business validations and integrations with other cloud applications and utilities cannot be overstated. Oracle EBS Financial modules have evolved over years of refinement and rigorous usage, necessitating Oracle EBS testing for meticulous impact analyses, even for minor enhancements or production tickets.

At Jade Global, we have a team of Certified Oracle Testing and QA Experts catering to end-to-end testing needs in enterprises like yours. By conducting thorough analyses, we precisely test scenarios and optimize them to minimize the risk of failure. With a proactive and automated approach to testing, we have helped businesses identify potential issues upfront, streamline resolutions, and reduce defects over time.